SRA Transparency Rules

The Solicitors Regulation Authority requires solicitors to provide information on the costs associated with certain types of work. We have provided the relevant information on those services which we offer as part of our business below.

Should you have any questions, please contact us.

Services

Residential Conveyancing

We typically advise high-net-worth individuals, their families, businesses and advisers on all aspects of residential sales and purchases as well as mortgages and re-mortgages. The precise cost of our services will depend on the facts and circumstances of the transaction and we will provide you with an estimate on engagement.

Fees

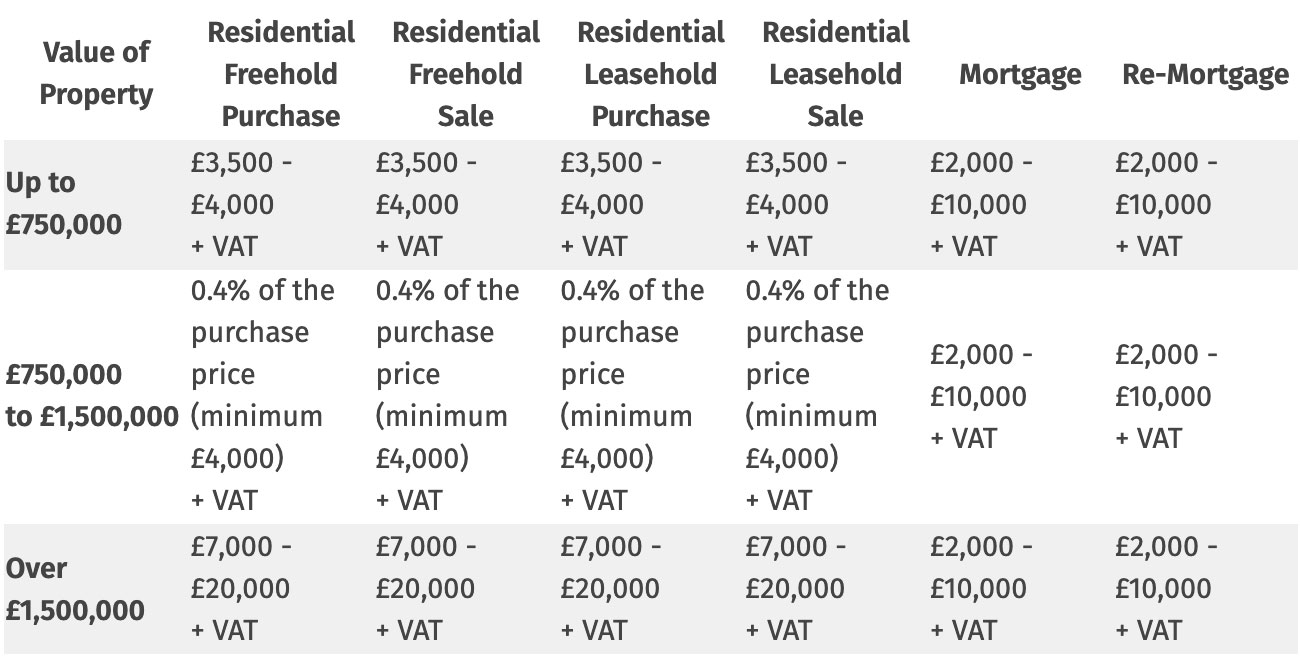

Using the example of a straightforward sale, purchase, mortgage or re-mortgage for a private individual, we estimate our fees would be:

Potential additional costs

The fee estimates listed in the table above exclude advice in relation to the structuring of a transaction or the taxation aspects of it. We do not advise on construction or planning elements or taxation. Should you intend to take out a mortgage, we will confirm if we are registered on your lender's panel and if we are able to act for you and your lender.

Our fee estimates assume that:

- it is a standard transaction and that no unforeseen matters arise including for example (but not limited to) a defect in title which requires remedying prior to completion or the preparation of additional documents ancillary to the main transaction

- the transaction is concluded in a timely manner and no unforeseen complication arise

- all parties to the transaction are co-operative and there is no unreasonable delay from third parties providing documentation

- no indemnity policies are required. Additional disbursements may apply if indemnity policies are required.

Where VAT is payable, it is currently charged at 20%.

Disbursements

Disbursements are costs related to your matter that are payable to third parties, such as search fees. We handle the payment of the disbursements on your behalf to ensure a smoother process. The disbursements which we anticipate will apply are set out separately below. This list is not exhaustive and other disbursements may apply depending on the transaction.

Residential Freehold Purchase

- Search fees: £500 - £650 + VAT

- Land Registry Fees: £40 - £910

- Telegraphic transfer fee: £20 + VAT per transfer

- Stamp Duty Land Tax: Depends on the purchase price and whether you (or your spouse or civil partner) own other residential property.

- Pre-completion searches/bankruptcy searches: £3 per search/name

- If documents need to be downloaded from the Land Registry, this will cost £3 per document.

Residential Freehold Sale

- Telegraphic transfer fee: £20 + VAT per transfer

- If documents need to be downloaded from the Land Registry, this will cost £3 per document.

Residential Leasehold Purchase

- Search fees: £500 - £650 + VAT

- Land Registry Fees: £40 - £910

- Telegraphic transfer fee: £20 + VAT per transfer

- Stamp Duty Land Tax: Depends on the purchase price and whether you (or your spouse or civil partner) own other residential property.

- Pre-completion searches/bankruptcy searches: £3 per search/name

- If documents need to be downloaded from the Land Registry, this will cost £3 per document

- If the Landlord's consent is required for the assignment and a rent deposit deed is needed (for non-UK resident purchasers) an additional fee of £750 - £1,500

- Landlord's fees for notice of assignment/ notice of charge: £30 – £100 + VAT

Residential Leasehold Sale

- Telegraphic transfer fee: £20 + VAT per transfer

- Management and service charge pack: £250 - £500 + VAT

- If documents need to be downloaded from the Land Registry, this will cost £3 per document

- The Landlord's solicitor will charge a fee for dealing with the consent to assign – approximately £750 - £1,500 + VAT.

Mortgage

- Search fees: £500 - £650 + VAT

- Land registry fee: £20 - £250

- Pre-completion searches/bankruptcy searches: £3 per search/name

- If leasehold, notice of charge fee - £30 - £150.

Re-mortgage

- Search fees: £500 - £650 + VAT

- Land registry fee: £20 - £250

- Pre-completion searches/bankruptcy searches: £3 per search/name

- If leasehold, notice of charge fee: £30 - £150.

Purchase of a freehold or leasehold residential property

Our fees cover the legal work required to complete the purchase of your property, deal with registration of the title in your name at the Land Registry and deal with the payment of Stamp Duty Land Tax (SDLT) to HMRC.

SDLT is payable on freehold and leasehold purchases. The level of SDLT payable depends on the purchase price of your property, whether you or your spouse or civil partner owns other residential property anywhere in the world and whether you are replacing your main residence. You can calculate the amount you will need to pay by using the SDLT calculator on HMRC's website. The fees set out above do not include advising you on your level of SDLT liability nor the availability of any reliefs. If you require advice on these areas, this can be provided separately and we will agree these fees with you.

What are the key stages of the process?

The precise stages involved in the purchase of a residential property vary according to the circumstances. However, the estimated fees will usually encompass:

- Taking your instructions and giving you initial advice;

- Checking finances are in place to fund the purchase;

- Receiving and advising on title and contract documents;

- Carrying out standard conveyancing searches;

- Making any necessary enquiries of the seller's solicitor;

- Giving you advice on all documents and information received and preparing a comprehensive report;

- Sending the final contract to you for signature;

- Ensuring you have received the landlord's approval to the assignment of the lease (if your property is leasehold and this is required);

- Agreeing the completion date;

- Exchanging contracts and notifying you that this has happened;

- Arranging for all monies needed to be received from you;

- Completing the purchase;

- Dealing with the payment of SDLT; and

- Dealing with the application for registration at the Land Registry.

How long will the purchase take?

The length of time the process will take can vary depending on a number of factors, but the average time leading to exchange of contracts is between 4 and 6 weeks. Factors that can change the timescale include any timings agreed between the parties, whether the property is fully constructed, if you are a first time buyer or in the case of a leasehold property, if the approval of the landlord is required. We will advise you of the likely timescales once we know the details of your particular purchase.

Sale of a freehold or leasehold residential property

Our fees cover the legal work required to complete the sale of your property, to repay any mortgages secured over it from the proceeds of sale and to account to you for the net proceeds of sale.

There are generally fewer disbursements payable on a sale than on a purchase. If your property is leasehold then you should expect to pay whoever manages the building a fee for the provision of a management and service charge pack. Details of the usual charges for this are set out above. If your lease says you need the landlord's approval in order to sell your flat then an additional fee will be payable to the landlord's solicitors. The level of this fee will vary and is usually between £500 + VAT and £750 + VAT.

What are the key stages of the process?

As part of the estimated fee, our work will include:

- Taking your instructions and providing you with initial advice;

- Reviewing the title to your property and obtaining copies of the title documents from the Land Registry;

- Preparing a contract;

- Arranging for you to complete standard pre-contract forms and advising you in relation to any queries you may have on these;

- Assembling a pre-contract package to send to your buyer's solicitors;

- If leasehold, obtaining a management and service charge pack from the managing agents of the building and applying for the landlord's consent to the sale (if required);

- Dealing with any enquiries raised by your buyer's solicitors;

- Agreeing the final form of contract and sending this to you for signature;

- Approving the draft transfer and arranging for this to be signed by you together with any licence to assign (if leasehold); and

- Dealing with completion and the repayment of any mortgage.

How long will the sale take?

The time the process takes can vary depending on a number of factors, including whether your buyer requires a mortgage and how quickly their mortgage offer can be obtained, or if there are a number of parties in a chain. The average period leading to an exchange of contracts is between 4 and 6 weeks. We will advise you of the likely timescales once we know the details of your particular purchase.

Mortgage or re-mortgage of a residential property

Our fees cover the legal work required to deal with your lender's requirements in taking security over the property. If you are re-mortgaging then we will also liaise with your existing lender to obtain the title deeds to the property and confirm the amount outstanding under your current mortgage. In circumstances where we are able to act for both you and the lender, we will advise you in relation to the terms of the lender's mortgage offer, its standard terms and conditions and the nature and effect of the legal mortgage that you would be required to sign in due course. We will also advise you on any special conditions contained in the mortgage offer and which you will need to comply with before the mortgage funds can be requested from the lender. We will also arrange the usual searches that we would expect to conduct on the purchase of a residential property.

What are the key stages of the process?

- Taking your instructions and establishing if we will be acting for you or both you and your lender;

- Dealing with the lender's due diligence requirements;

- Organising standard conveyancing searches;

- Liaising with your lender's valuer in relation to any queries that may be raised in the valuation report;

- Providing a certificate of title to your lender and requesting the mortgage advance;

- Liaising with your existing lender (if applicable) in relation to the redemption of the existing mortgage;

- Completing the mortgage and arranging registration at the Land Registry; and

- If the property is leasehold, giving notice of the charge to your landlord.

How long will the mortgage or re-mortgage take?

The duration of the mortgage or re-mortgage process is dependent upon a number of factors including the speed with which the lender issues the mortgage offer, whether or not there are any complexities with the title and whether or not there are a significant number of conditions with which you will need to comply with prior to completion of the mortgage. We will advise you of the likely timescales once we know the details of your particular mortgage or re-mortgage.

Employment Tribunal

We provide advice to both claimants and respondents in relation to claims for unfair dismissal and wrongful dismissal before employment tribunals. Sometimes other claims can be involved (for example breach of contract, discrimination or whistleblowing claims) which add a degree of complexity to the claims. Exact costs will depend on the individual facts and circumstances of each matter and we will provide you with an estimate dependent upon your specific facts and circumstances.

Fees

Our typical fee range for acting for individual claimants or business respondents, in employment tribunals:

| Type of Case | Range of cost £ |

|---|---|

| Simple case | 15,000- 30,000 plus VAT |

| Medium complexity case | 30,000- 50,000 plus VAT |

| High complexity case | 50,000- 80,000 plus VAT |

We normally base our charges on hourly rates, which will vary depending on the seniority and experience of lawyers who carry out your work. Our hourly rates range from £150 to £300 plus VAT for non-partner fee earners and £350 to £485 plus VAT for partners.

The fee estimates are based on the following assumptions:

- The claim involves a single individual claimant or single business respondent, rather than multiple parties;

- There are no unexpected or unusual circumstances in the litigation, or compounding factors such as overlapping claims of unlawful discrimination, whistleblowing/protected disclosures, or other claims for breach of contract apart from wrongful dismissal;

- A reasonable degree of cooperation by opposing parties and their advisers in accordance with the Employment Tribunal Rules of Procedure;

- The location within the UK; and

- The urgency of the case.

Where VAT is payable, it is currently charged at 20%.

Disbursements

We will also charge for disbursements that we pay on your behalf. This would mainly include any photocopying charges and courier fees and can typically range from £100 to £5,000. There will also be a cost for Counsel's fees. The amount will depend on the complexity of the case, the experience of the advocate and the number of days the case is listed for hearing in the tribunal, with fees typically ranging from £1,000 to £10,000 plus VAT per day for attending a hearing (including preparation).

What are the key stages of the process?

As part of our estimated fees we will cover:

- Taking your instructions and giving you initial advice;

- Entering into Acas pre-claim conciliation to explore whether settlement can be reached;

- Preparing your claim or response;

- Reviewing and advising on the claim or response from the other party;

- Exploring settlement opportunities throughout the process;

- Preparing or considering a schedule of loss;

- Preparing for a preliminary hearing (if required), which may include instructions to counsel to attend;

- Reviewing the documentary evidence in the case to determine what should be disclosed to the other party, exchanging documents with the other party and agreeing the relevant documents to be relied upon at the hearing;

- Meeting the witnesses, taking and preparing their statements for exchange;

- Agreeing a list of issues with the other party; and

- Preparing for and attending the final hearing, which may include instructions to counsel to attend.

How long will this take?

The time that it takes from taking your initial instruction to the final resolution of your matter depends largely on the stage your case is resolved. If a settlement is reached during pre-claim conciliation, your case is likely to take 1-2 months. If your claim proceeds to a final hearing, your case is likely to take up to 12 months, or longer if the hearing is expected to take 5-10 days.